Director Fee Subject To Epf Malaysia

If you are not drawing a salary but accepting a director s fee you do not have to contribute to the epf.

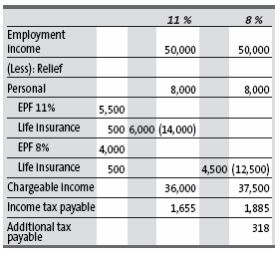

Director fee subject to epf malaysia. Director salary bonus have to combo with kwsp which is good in a way that kwsp is tax exempted. You need to give numbers for people advise accurately. He can also be an employee on a contract of employment if you are still on a contract of employment for which you are paid salary separately then you need to contribute to the epf based on yr earnings as an employee.

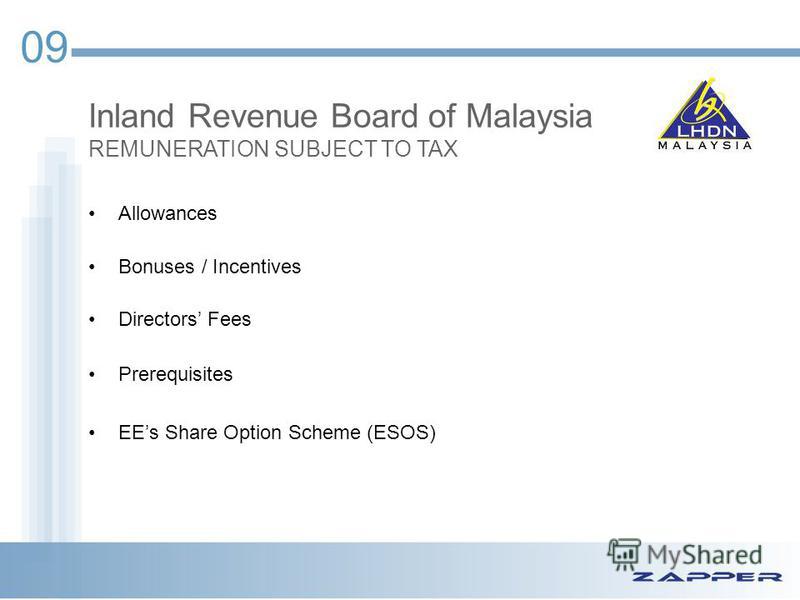

No non malaysian employees are not required to contribute but they are given the option to contribute. Since you have secure your income you need to start to have proper tax planning. Try fully utilize sdn bhd lower band tax of 19.

Epf contribution rates. Under section 45 of the employees provident fund act 1991 epf act employers are statutorily required to contribute to the employees provident fund commonly known as the epf a social security fund established under the epf act to provide retirement benefits to employees working in the private sector. The extent of the employers obligation to contribute is limited in 2 ways.

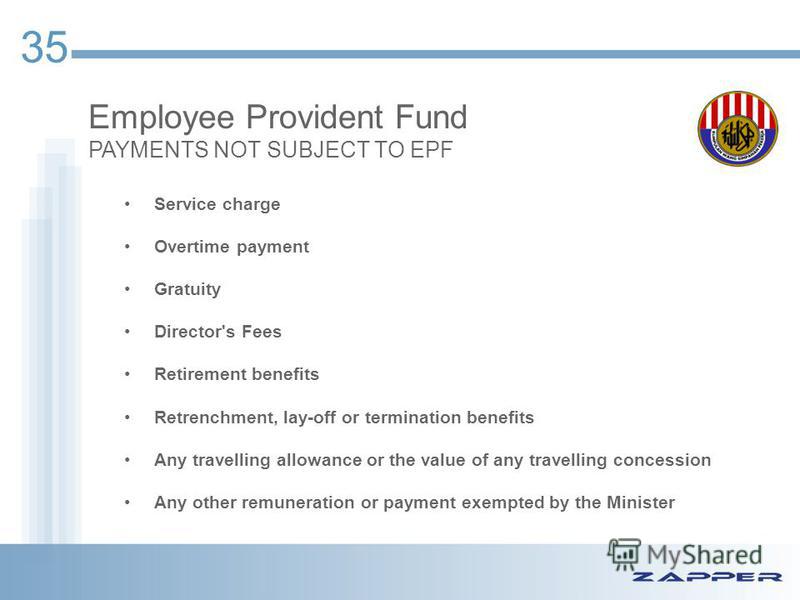

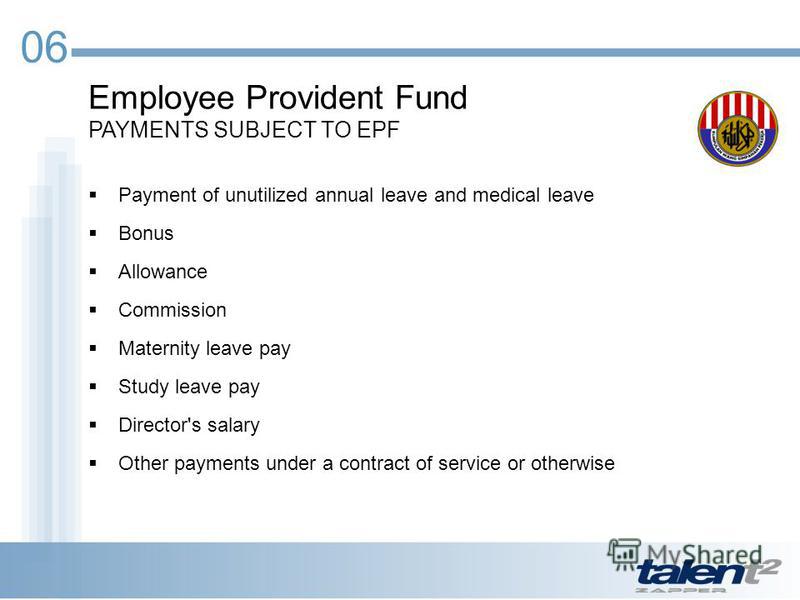

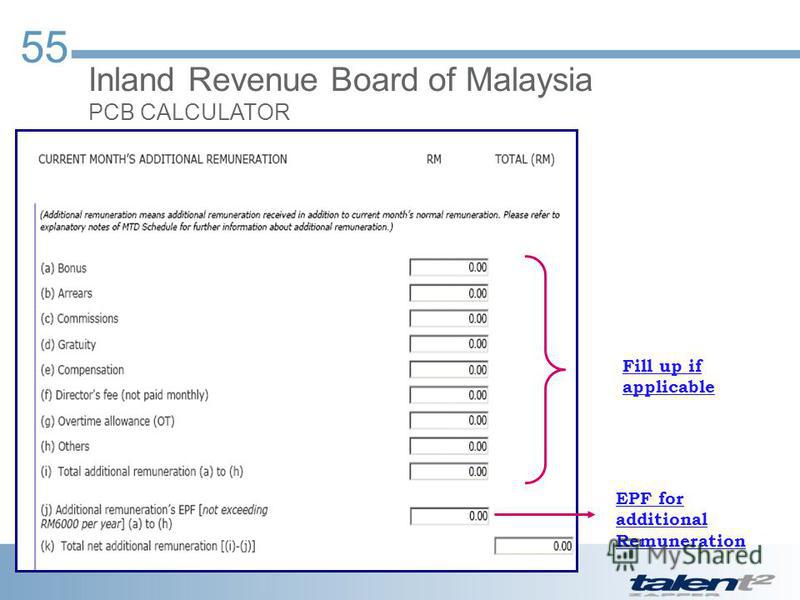

Generally all wages paid to the directors staff employee workers are subject to epf deductions. Cpf contributions are not payable on directors fees voted to them at general meetings. Director fee is like a project basis fee.

Subject to the provisions of section 52 every employee and every employer of a person who is an employee within the meaning of this act shall be liable to pay monthly contributions on the amount of wages at the rate respectively set out in the third schedule. Gifts includes cash payments for holidays like hari raya christmas etc read more about. Info epf temporarily closes all branches in selangor kuala lumpur and labuan due to cmco 17 oct info epf klang to resume counter services via janji temu online 16 oct info official statement 13 oct info epf temporarily closes all branches in sabah due to cmco terms conditions.

Directors of a company are considered employees if they are engaged under a contract of service and paid a salary on top of any directors fees received. Payment for unutilised leaves including annual medical leave bonuses. Wages in lieu of notice of termination of employment.

Do foreigner expatriate employees have to contribute epf. The payments by the employers subject to deductions are. Director s fee fee paid to the director.

Hence the earliest date on which the director is entitled to the director s fees is the date the fees are voted and approved at the company s agm. Director s fees approved in arrears the company voted and approved director s fee of 20 000 on 30 jun 2019 to be paid to you for your service rendered for the accounting year ended 31 dec 2018.