Business Income Tax Form

The list should not be construed as all inclusive.

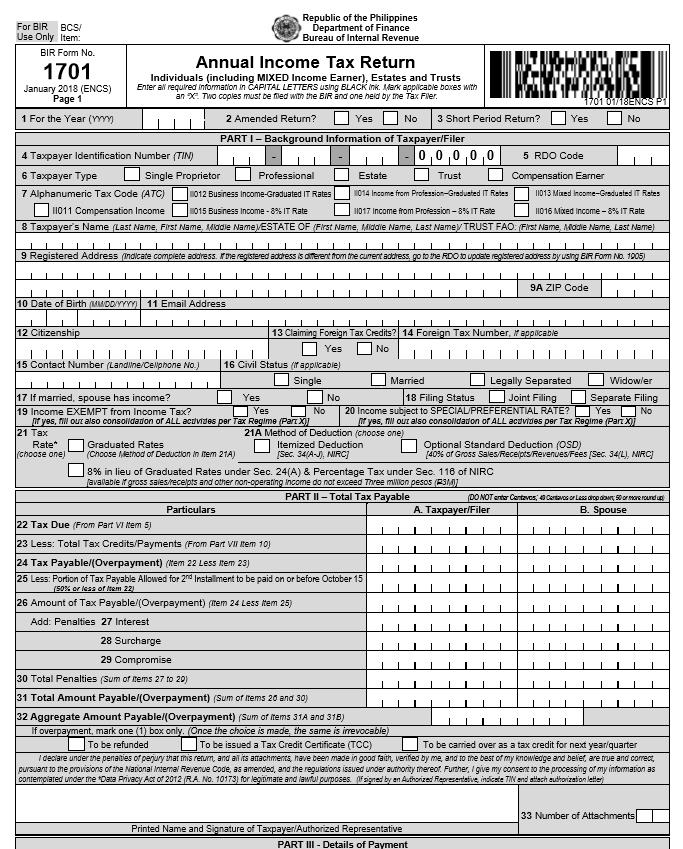

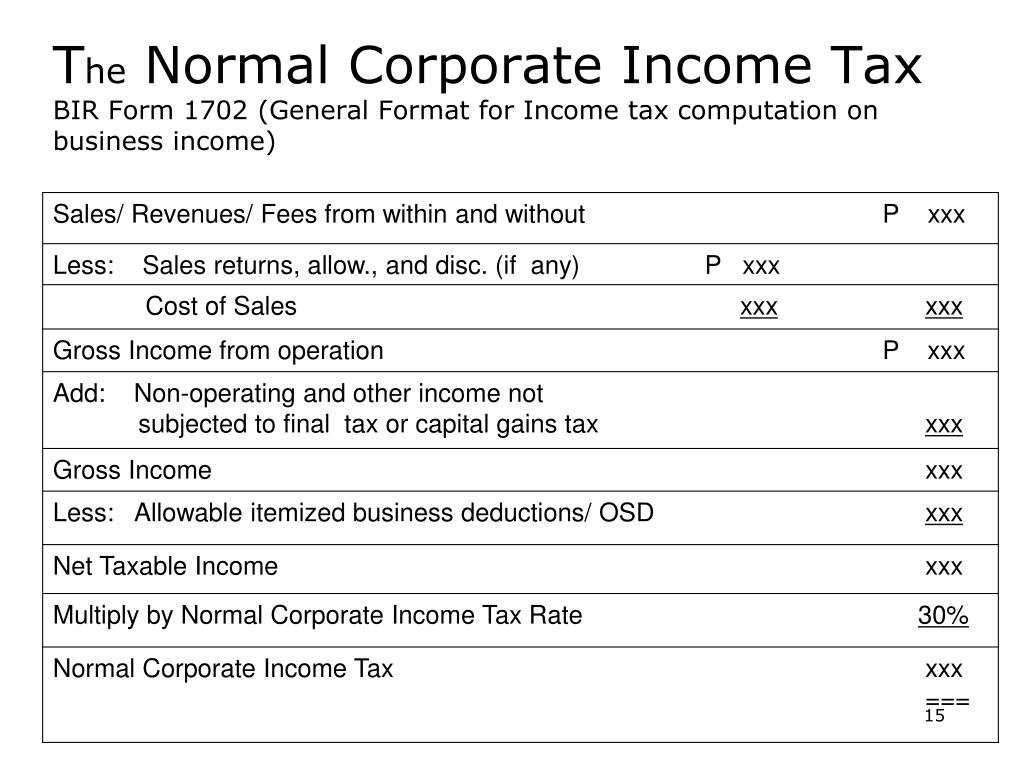

Business income tax form. Business income is taxable at individual personal income tax rates. List of business codes for itr forms for a y. Before filing of income tax return we must itr ensure correct business sector along with correct business code has been selected.

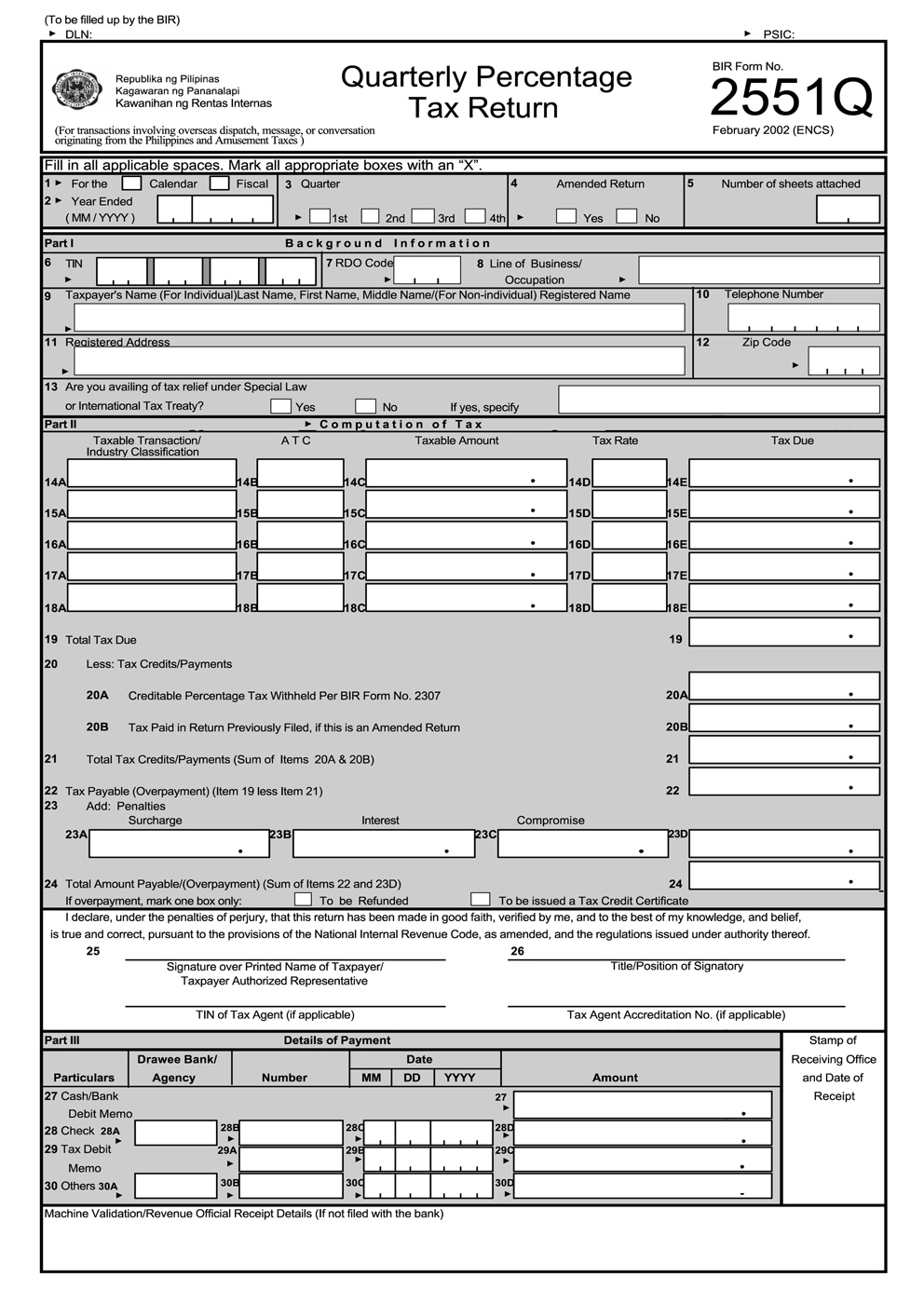

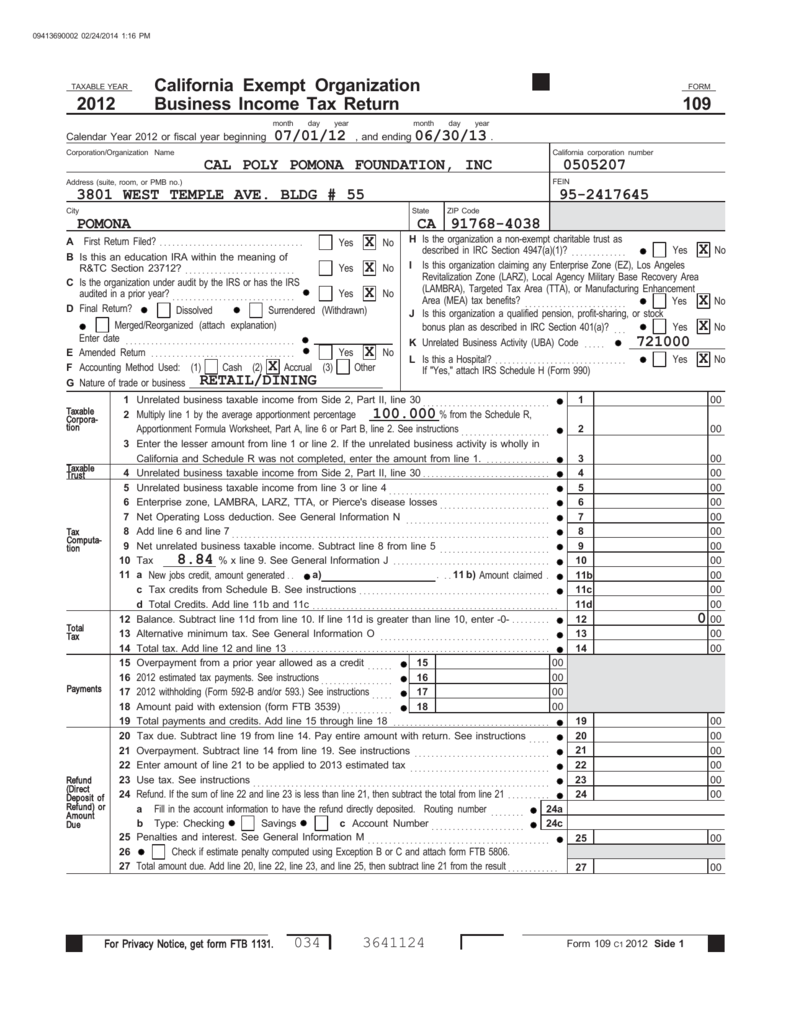

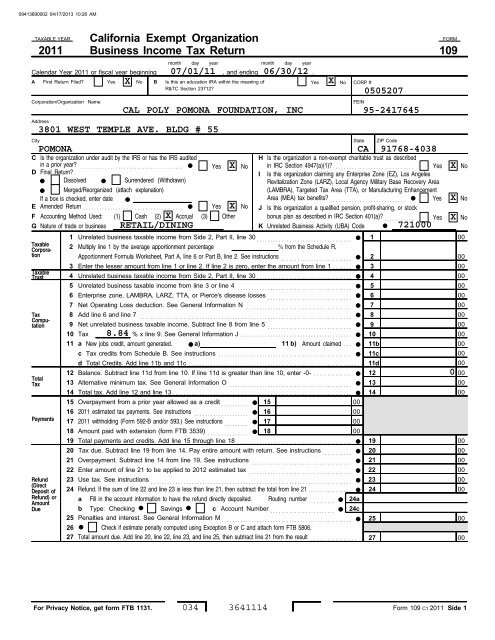

Business income tax forms information about 2020 estimated payment changes due to covid 19 can be found in informational bulletin fy 2020 26. Other forms may be appropriate for your specific type of business. Return of employee s remuneration form ir8a for the year ended 31 dec 2020 year of assessment 2021 form ir8a doc 126kb form ir8a explanatory notes pdf 100kb.

All businesses except partnerships must file an annual income tax return. You should consult the instructions for each form for any related forms necessary to file a complete tax return. Many small business owners must pay estimated taxes because they don t earn a salary so no taxes are withheld from their income or self employment.

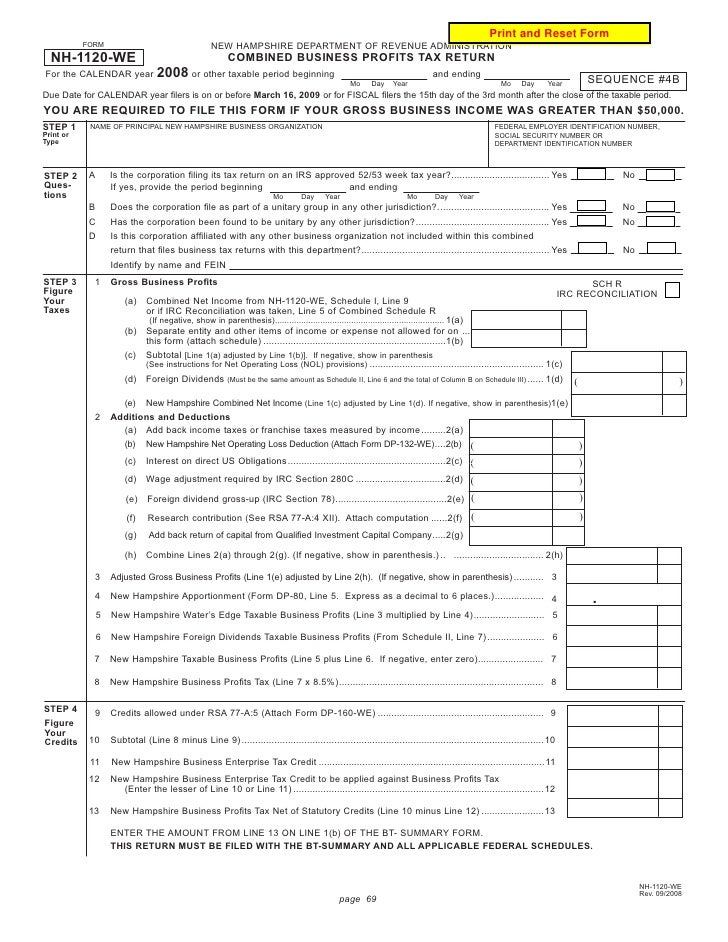

Form used by a corporation to declare and remit estimated income tax for tax year 2020. Paying estimated taxes. This form combines the two previous forms t2124 statement of business activities and t2032 statement of professional activities.

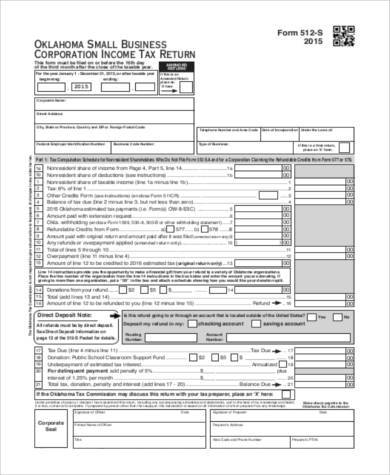

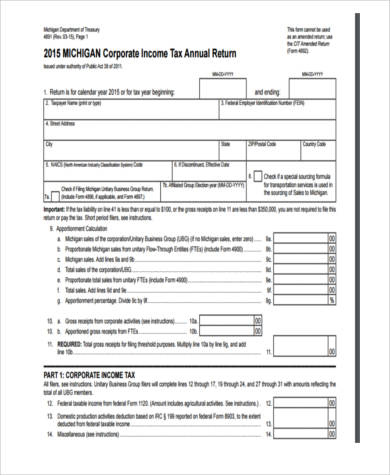

Declaration of estimated corporation income tax. 2019 20 mentioned below also read business codes for itr forms for a y 2018 19. Partnerships file an information return.

This section provides links to a variety of forms that businesses will need while filing reporting and paying business taxes. Income tax forms for employers. If you don t pay enough taxes during the year you must pay estimated taxes.

The federal income tax is a pay as you go tax. Use this form to report either business or professional income and expenses. Refer to business structures to find out which returns you must file based on the business entity established.

The t4002 contains information for self employed business persons commission sales persons and for professionals on how to calculate the income to report on your income tax return. The form you use depends on how your business is organized. How business income is taxed.

Form name last updated 1a. Pass through entity income tax forms. April 15 july 15 october 15 of the current year and january 15 of the following year.

2020 business income tax forms and instructions corporation income tax forms.

:max_bytes(150000):strip_icc()/Screenshot43-d22959eda68841df96f3e8f1bb223a34.png)